The most recent stats on VGTR were published in August 2021. To access the most recent report, click here.

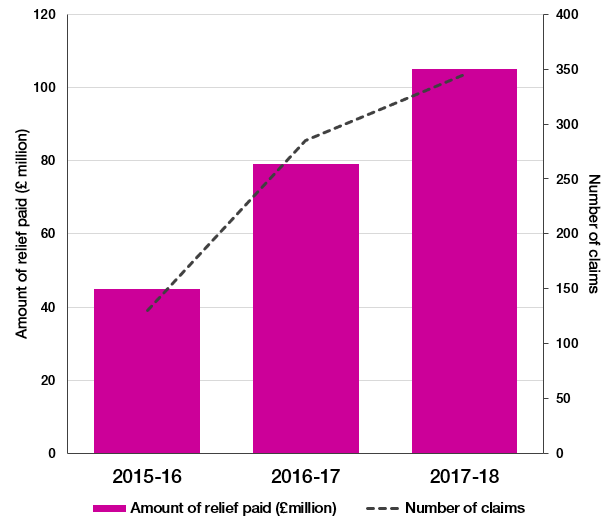

New figures from HMRC published in July 2018, show that for the first time since its inception, over £100m in Video Games Tax Relief was paid out in the financial year 2017-18, with 345 claims receiving a combined total of £105m.

These figures mean that the total amount of VGTR paid out to date has nearly doubled from the previous year to reach £230m over 770 claims.

Number of claims and amount of VGTR paid - April 2015 to March 2018

VGTR has now been claimed by 480 video game productions, accounting for over £1bn in UK expenditure.

There was a noticable increase in claims for smaller amounts in 2017-18, with those seeking less than £5,000 increasing from 11% in 2016-17 to 19% of all claims. Overall, 70% of 2017-18 claims were for amounts less than £100,000, although these accounted for just 5% of the amount paid out. The largest claims, for amounts over £500,000, accounted for 13% of claims but the majority of VGTR paid (84%).

The 2017/18 numbers may yet increase as HMRC continue to receive claims.

Dr Jo Twist, CEO of Ukie, said, “It's great to see a positive uptake on claiming Video Games Tax Relief, and it reflects the flexibility of the system for games as a service claims. But we know there are a lot more companies who could be using it. It's a modern system that supports a modern industrial model.

"There is advice and support available from BFI and legal or accountancy firms to guide businesses through the steps. VGTR is critical to the growth of the industry and provides an important incentive and confidence in UK games development. It opens up routes to financing and, along with funds such as the UK Games Fund, is invaluable for developers of all sizes. We look forward to the BFI's economic impact assessment report expected later this year, which will show how much return on investment is being delivered back to the UK economy for every £1 in tax relief."