The UK consumer games market reached a record figure of £7.16bn in 2021, growing by 1.90% from the previous record of £7bn recorded during the height of the COVID-19 pandemic in 2020. On the basis of the growth we've seen, the games market 2022 figures should look similar.

The valuation, which takes place every year ahead of the start of the London Games Festival, explores how much money consumers in the UK spend on game software, game hardware and on game culture (such as toys, movies and books).

Compiled with the support of our data partners ABC, The BFI, GfK Entertainment, Kantar, OCC, Omdia, Nielsen and NPD – alongside analysis from Ukie’s insight and innovation team – the valuation provides a detailed examination of the size, scale and make up of the country’s consumer games market.

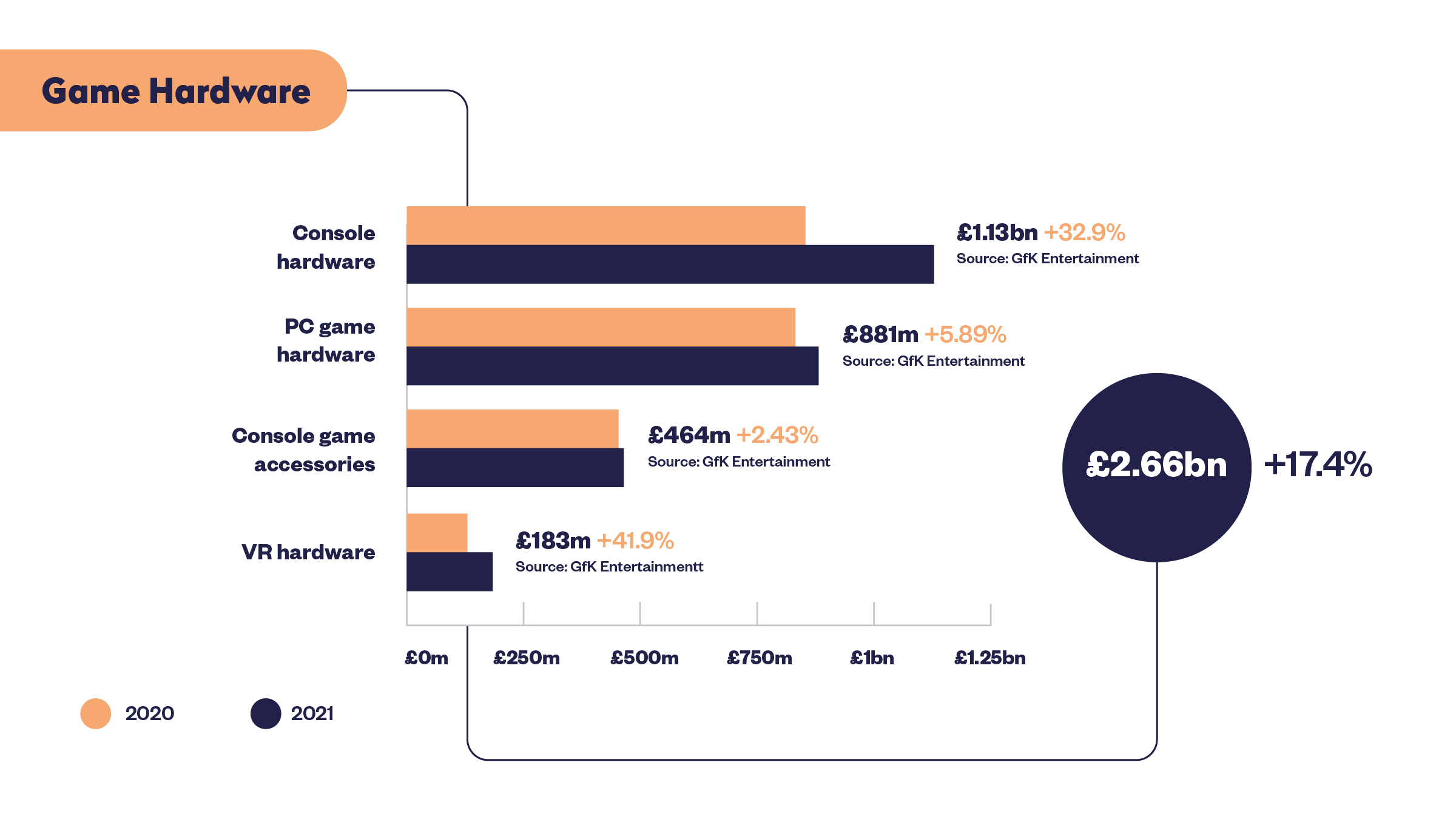

How much money was spent on game hardware in the UK in 2021?

Game hardware sales grew by 17.4% year on year to reach £2.66bn in 2021 – further increasing upon the record total seen in 2020’s consumer valuation.

The main driver of the growth in hardware sales in the UK was a significant bump in the sale of console hardware. The category grew by 32.9% from 2020, reaching a record figure of £1.13bn that propelled the overall market to new heights.

“2021 was the first full calendar year for Sony’s PS5 and Microsoft’s Xbox Series consoles,” said Dorian Bloch, Senior Client Director at GfK Entertainment. “Both made a huge impact in Q4/20 at launch, with consumer demand outstripping supply, so there is no surprise that this is the best year since the all-time peak back in 2008.

But we should not forget that Nintendo’s Switch also enjoyed another big year in 2021. This is a fifth year at market for the Switch, which has been rejuvenated and refreshed a number of times since 2017 - most notably with Switch Lite in 2019 and Switch OLED in 2020.”

There was also a significant growth in Virtual Reality (VR) hardware sales. The category reached a new high of £183m, recording an increase of 41.9% compared to 2020. The increase occurred shortly before the Oculus Quest 2 was officially renamed the Meta Quest following its parent company’s rebrand in November 2021.

There was also minor growth in the PC game hardware and console game accessories, with each growing by 5.89% (£881m) and 2.43% (£464m) across the course of 2021.

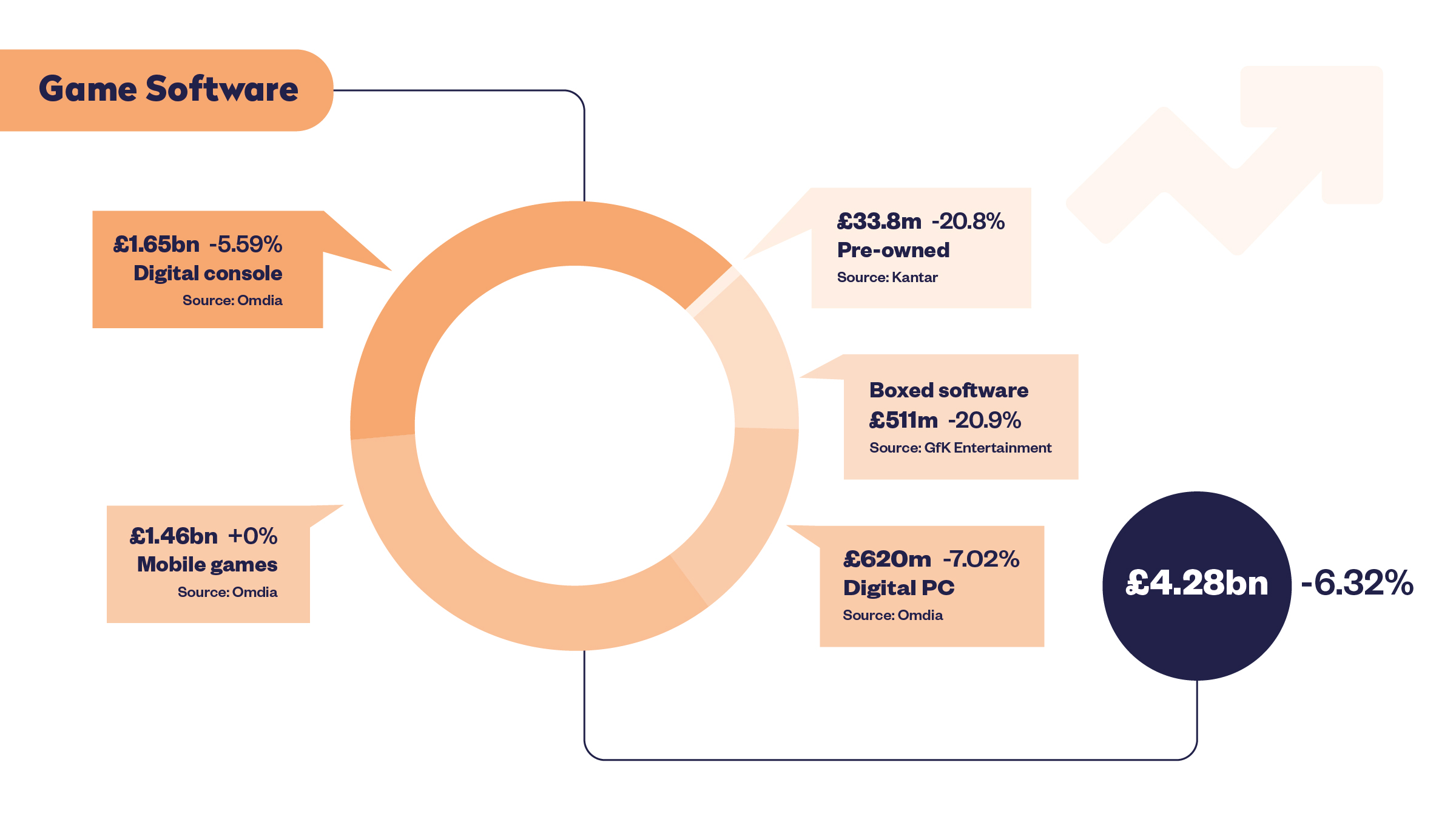

How much money did consumers spend on video game software in the UK in 2021?

The consumer game software market was valued at £4.28bn in 2021. This means that spend declined by 6.32% in comparison to 2020 but has grown 11.4% in comparison to a £3.84bn total from revised 2019 figures.

Spend on digital console games reduced by 5.59% to £1.65bn with digital PC revenues down by 7.02% to £620m. The lack of major releases such as Animal Crossing: New Horizons and The Last of Us Part II had a downward effect on the market, but that effect should be seen in the context of the impressive performance of software during the pandemic.

“The important story here is of how much of the lockdown-related boost seen in 2020 has been successfully retained during 2021’s year of correction,” said Steven Bailey, Senior Analyst (Games) at Omdia, commenting on the digital games market.

“We expect a return to growth for most digital areas in 2022, as game-makers continue creating new standards of compelling content, and explore combinations of business models that can help keep people engaged and connected even during unstable times.”

There was also a downturn in the sale of physical games against 2020. Both boxed software and pre-owned sales declined significantly against the figure posted in 2020, recording a 20.9% reduction to £511m and a 20.8% reduction to £33.8m respectively. However, the decline versus 2019 was less marked – suggesting that the downturn recorded in 2021 is relatively in line with historical falls in the sector occurring since 2013.

Mobile game revenues held steady at £1.46bn with the market less affected by the lack of major new releases that hit both the console and PC market.

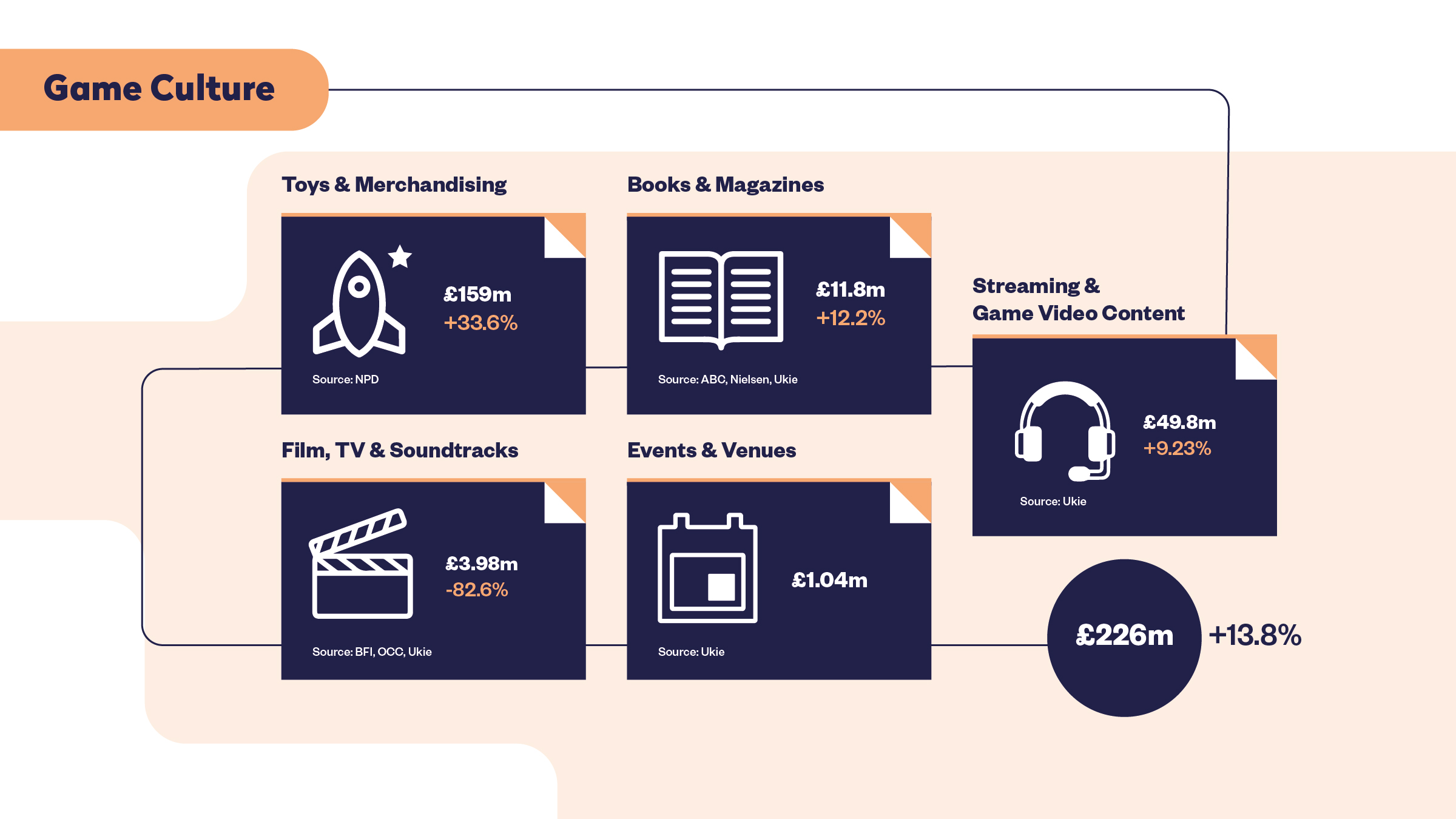

What did UK consumers spend on video game culture in the UK in 2021?

Spend on video game culture continued to grow in 2021, increasing by 13.8% from 2020 to reach a total of £226m.

Sales of Toys & Merchandising was the biggest factor in the growth in games culture spend, increasing by 33.6% from the previous high of £119.6m to £159m.

“Video and Digital Game related toys have seen consistent double-digit growth in the UK for the last three years and are now 5% of total UK Toys sales,” said Melissa Symonds, Executive Director of UK Toys at NPD.

“Pokemon was not only the fastest growing video game related property, but also the fastest growing property across the total toy market last year. It demonstrates that kids and adults alike, love to play with their favourite gaming characters in all formats.”

Revenue in the Books and Magazines and in the Streaming & Game Video Content categories also both grew, reaching £11.8m and £49.8m respectively.

There was, however, a decline in the Film, TV & Soundtracks category. It declined 82.6% to£3.98m in 2021, with the market suffering both from reduced box office takings and a limited number of releases based on video game IP – something likely to shift in 2022’s valuation as the sequel to 2020’s hit film Sonic the Hedgehog hits the market.

There was also something of a bounce back in the Events & Venues category, with the market recording £1.04m in comparison to a little over a quarter of a million pounds in 2020. However, we felt year on year comparisons were reductive due to the outsized impact of COVID-19 on the category and we believe that 2022 figures will be more reflective of the space against the previous total recorded in 2019.

“The UK consumer games market has consolidated effectively following significant growth during the COVID-19 pandemic,” commented Dr Jo Twist OBE, CEO of Ukie. “The UK is a nation that loves its video games and we should be proud of the positive contribution this sector makes to the economy, to our culture and to wider society.”

UK Consumer Games Market Valuation

2021

|

Revenue |

YOY Change |

Source |

|

|

Game Software |

|

|

|

|

Pre-owned |

£33.8m |

-20.8% |

Kantar |

|

Boxed software |

£511m |

-20.9% |

GfK Entertainment |

|

Digital PC |

£620m |

-7.02% |

Omdia |

|

Digital console |

£1.65bn |

-5.59% |

Omdia |

|

Mobile games |

£1.46bn |

- |

Omdia |

|

Total |

£4.28bn |

-6.32% |

|

|

Game Hardware |

|

|

|

|

Console hardware |

£1.13bn |

+32.9% |

GfK Entertainment |

|

PC game hardware |

£881m |

+5.89% |

GfK Entertainment |

|

Console game accessories |

£464m |

+2.43% |

GfK Entertainment |

|

VR hardware |

£183m |

+41.9% |

GfK Entertainment |

|

Total |

£2.66bn |

+17.4% |

|

|

Game Culture |

|

|

|

|

Toys & Merchandising |

£159m |

+33.6% |

NPD |

|

Books & Magazines |

£11.8m |

+12.2% |

Nielsen, ABC, Ukie |

|

Film, TV & Soundtracks |

£3.98m |

-82.6% |

BFI, OCC, Ukie |

|

Events & Venues |

£1.04m |

* |

Ukie |

|

Streaming & Game Video Content |

£49.8m |

+9.23% |

Ukie |

|

Total |

£226m |

+13.8% |

|

|

Grand Total |

£7.16bn |

+1.90% |

|

*Percentage not

presented as not reflective of actual change following impact of pandemic in

2020