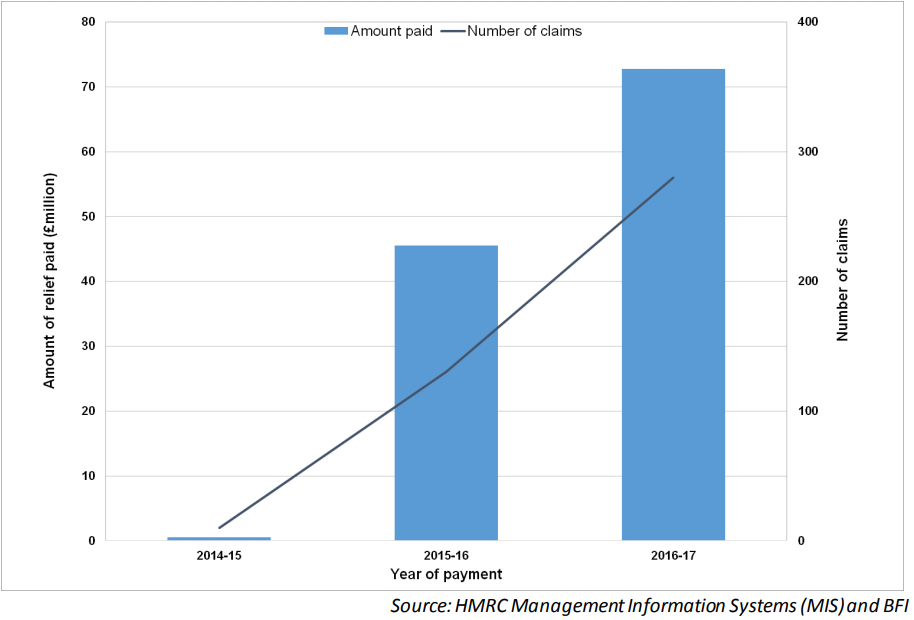

The latest figures from HMRC, released this morning, show that £73m in Video Games Tax Relief was paid out relating to 280 claims in 2016/17. This represents a 60% increase in payments from 2015/16 (£45.5m) and a 115% increase in claims (up from 130). These figures bring the total relief paid out since the relief's introduction in April 2014 to £119m, relating to 420 claims.

Number of claims and amount of VGTR paid - April 2014 to present

The report also shows that 90 video games that claimed VGTR were completed in 2016-17, with UK expenditure of £163 million. A total of 295 video game productions have to claimed the relief to date, supporting over £690 million of UK expenditure.

Since April 2014, 835 games have applied for certification of which 400 have been granted final certification and 375 granted an interim certificate. These 775 qualifying games account for a total expenditure of £1.6 billion of UK expenditure, which accounts for 83% of their total expenditure (£1.9bn). In 2016/17, there were 225 qualifying video games, with £449 million UK expenditure and £549 million total expenditure.

The 2016/17 numbers may yet increase as HMRC continue to receive claims.

Dr Jo Twist, CEO of Ukie, said, “The landscape of the UK games sector would be completely different without the evident contribution of the Video Games Tax Relief. The VGTR directly creates jobs, fuels technical and creative innovation, and allows the UK to be a real global player in the games and interactive entertainment sector.

Government support, particularly through the tax relief, is a huge contributor to what makes the UK games industry globally competitive, and it was encouraging to see support lent to building on the creative tax reliefs in their election manifesto. The certainty the scheme gives to the sector is vital in continuing to drive investment, employment, innovation, and to maintaining the competitiveness of our sector.”