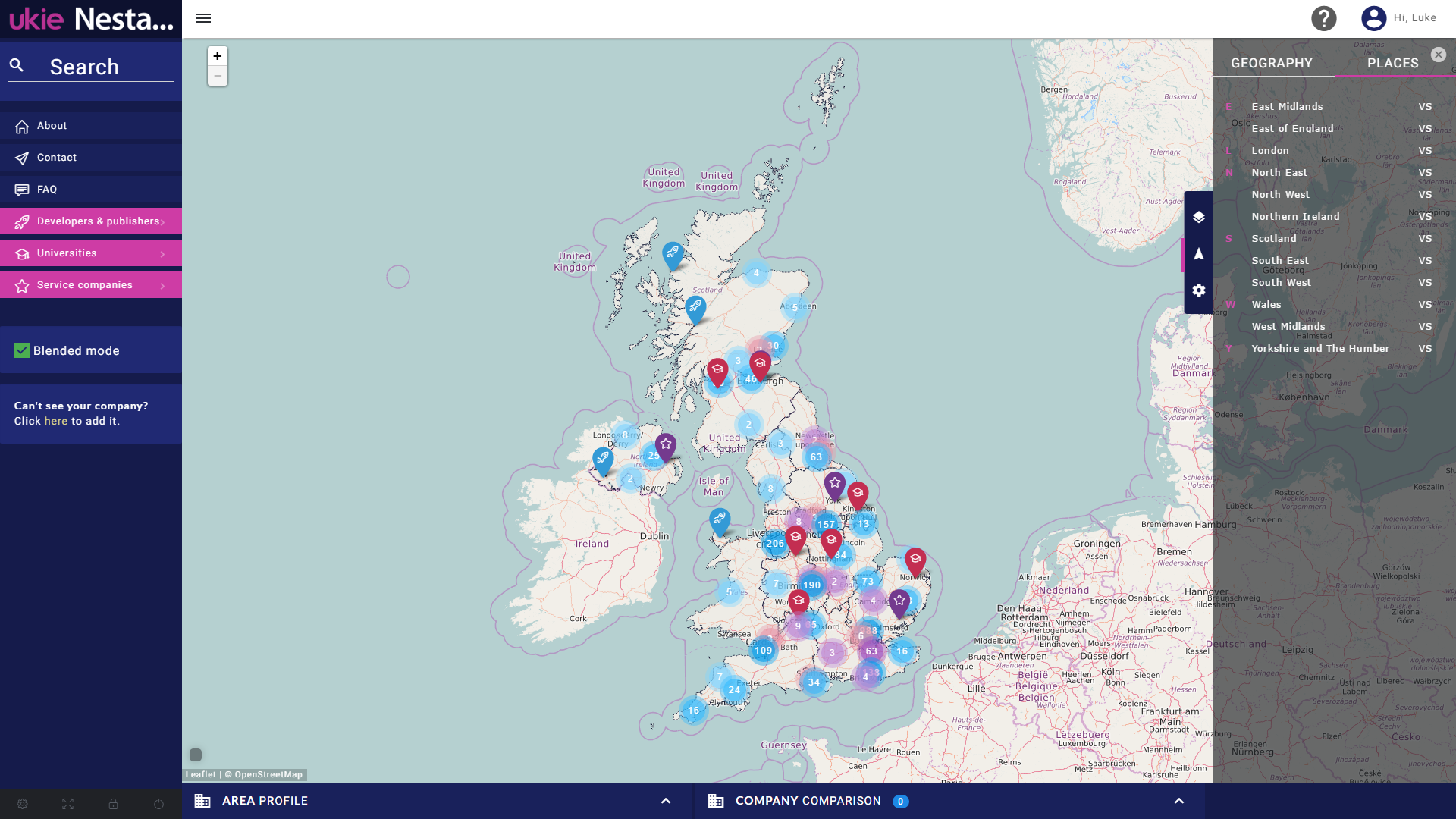

Last week at the Ukie AGM, we launched the UK Games Map - gamesmap.uk - the first interactive, real-time map of the UK games industry.

(NOTE: to read how things are going 10 days after launch, check out our blogpost here)

Built in partnership with Nesta, the UK's innovation foundation, the map builds on the methodology established in the 2014 Ukie/Nesta report A Map of The UK Games Industry to provide the most complete dataset of the geography of the UK games sector ever compiled.

This is achieved by a process that marries automation and crowdsourcing. For the automation, we use a big data approach to harvest the wealth of information in publicly available games directories and then cross-referencing this against the data held by Companies House, identifing UK based-games companies and gathering a host of useful information about them. This data is then reviewed and, if necessary, amended before publication to the map.

While the automation is highly effective at gathering the huge amounts of information available and distilling it to the UK games companies we can see on the map, no process is perfect - which is where we turn to the best source of information about the industry - the companies themselves - crowdsourcing across the industry hive-mind to capture details like business size and recent changes of address. Also, as the automation is reliant on businesses having released a game to market, crowdsourcing allows us to add in all the start-up companies working on their first game - a part of the games sector that unitl now has been very hard to gather relable data on.

At launch, the UK Games Map mapped 2,472 UK games companies, from Land's End to the highlands of Scotland, and already, just a few days in, we've received dozens of submissions from games businesses updating their details or adding themselves to the map. Working together like this can ensure the UK Games Map's future as the authority source for UK games business data - created by the industry, for the industry.

One of the things we see is that sometimes companies use a different registered address, such as their lawyers or accountant, but are actually based elsewhere - we'd like to encourage companies to make sure they're listed as being where they're actually based, so that we can better understand the regional spread and economic impacts of clusters. Addresses and postcodes are not made publicly available in the platform to protect privacy concerns - even if the address is already publicly available via Companies House.

What we can already see is that the UK games industry is a fast-evolving, dynamic place, with 1,949 active games businessses in the UK registered at the time of launch and two-thirds (66%) of those companies were founded since 2010. This rapid growth and change means that official stats about the industry have often had trouble classifying and tracking our size, scale and geography - something the UK Games Map is designed to fix.

By making the data open, searchable and accessible, the UK Games Map provides policymakers, as well as investors, academics, journalists, organisations and the industry itself, with an invaluable tool and data source to better understand the UK games industry.

The map can also have a direct positive impact for the listed games companies, who can use the map to connect with other businesses, skill share and build local networks and link in with the talent pipeline from local games courses - hopefully ultimately driving more business.

One of the important facts that the map has highlighted is that only 41% of companies listed use the games industry SIC codes. These Standard Industrial Classification codes are used to categorise businesses for inclusion in official statisics and so if less than half of games businesses are using the right codes the sector is continually being underrepresented in national and international figures. It's also apparent that correct SIC coverage varies across different business types, with console specialists more likely to have the right SIC code (62%) than games businesses that specialise in mobile (35%). You can find out how to check and change your businesses SIC code in Ukie's step-by-step guide.

The UK Games Map shows the UK games industry is a leading powerhouse in the UK's innovative, creative economy. We encourage all games businesses to get involved - established busineses can check out and update their profiles and new start-ups should add themselves to make sure they're counted as part of the industry. Together we can ensure that the UK games industry puts itself on the map.

For any questions, comments or suggestions on features or improvements, contact info@gamesmap.uk.

For a quick guide to the map, below are the slides from the Ukie AGM lunch @ EGX 2016.